AMERICANS ARE RACKING UP HUGE

CREDIT CARD BALANCES ONCE AGAIN

AND SOME OF THE INTEREST RATES

ARE ABSOLUTELY OUTRAGEOUS!

This is absolutely beyond belief. I am so astonished at this that I am at a loss for words. How can people be so stupid? How can they not see what is going on? How can they not discern the difference between "need" and "want"? They are selling themselves into absolute bondage to the bankers, it is almost like donning the mark of the beast by agreeing to sell one's soul for a little more credit.

If the stakes were not so high, I would say, reap what you sow, fools. But I am just not that cruel.

The Trading Report

Feb 8, 2011

Feb 8, 2011

Well, it was nice while it lasted. One of the really good things that came out of the recent economic downturn was that millions of American families decided to get out of debt. In particular, we had seen a sustained trend of reduced credit card usage in the United States. It looked like Americans had finally wised up. But we should have known that Americans would not be willing to tighten their belts forever.

Unfortunately, it appears that getting out of debt is no longer so “trendy”. In fact, the month of December was the third month in a row in which consumer credit grew in the United States. Prior to that, consumer credit in the United States had declined for 20 months in a row. The American people were doing so, so well. Why did they have to stop?

It appears that the American people have fallen off the wagon and have gotten a taste for credit card debt once again. This time, however, the credit card companies are back with interest rates that are higher than ever. In fact, one national credit card company has hundreds of thousands of customers signed up for a card that charges interest rates of up to 59.9%.

59.9%?!

You mean there are people that are stupid enough to actually sign up for a credit card that will charge them 59.9% interest?

Unfortunately the answer is yes.

In fact, the top rate was 79.9% before First Premier Bank lowered it.

These cards are targeted at Americans that have a poor credit history, and these days there are a whole lot of those.

(Now we know why Jesus threw those money changers out of His father’s house. Usury such as this is beyond criminal!)

A recent story on the website of CNN described how large numbers of U.S. consumers with poor credit are gobbling up credit cards like these. Unfortunately, many of these consumers are also not smart enough to realize what they are getting into. The CNN story contained a quote from a woman who was in complete shock when she discovered that her interest rate was going to go up by 50 percentage points….

“I about had a heart attack when I got a disclosure notice saying that my starting rate of 29.9% was going up to 79.9%.”

First Premier Bank has since lowered the top rate on those cards to 59.9%, but that it still completely outrageous.

Remember, this is COMPOUND interest!

Not only are the interest rates on those cards super high, but they also charge a whole bunch of fees on those cards as well. The following are some of the fees that First Premier Bank charges….

*$45 processing fee to open the account*Annual fee of $30 for the first year*$45 fee for every subsequent year*A monthly servicing fee of $6.25

So you would think that nobody in their right mind would ever sign up for such a card, right?

Wrong.

CNN is reporting that almost 700,000 Americans have signed up for the card.

Ouch.

In fact, CNN says that First Premier Bank gets between 200,000 to 300,000 new applications a month for the card, but that they only open about 50,000 new accounts each month.

Are there really this many Americans that are this gullible?

If Americans would just remember the “DBS” rule they would be so much better off.

DBS = Don’t Be Stupid

Do you know how long it would take to pay off a credit card with a 59.9 percent interest rate?

Just a 20 percent interest rate is bad enough.

According to the credit card repayment calculator, if you owe $6000 on a credit card with a 20 percent interest rate and only pay the minimum payment each time, it will take you 54 years to pay off that credit card.

During that time you will pay $26,168 in interest rate charges in addition to the $6000 in principal that you are required to pay back.

Ouch!

The number one piece of financial advice that most of the “financial gurus” give is that you should get out of credit card debt ~ particularly credit card debt that has a high interest rate.

Unfortunately, 46% of all Americans carry a credit card balance from month to month today.

According to the United States Census Bureau, there are approximately 1.5 billion credit cards in use in the United States.

Of U.S. households that have credit card debt, the average amount owed on credit cards is $15,788.

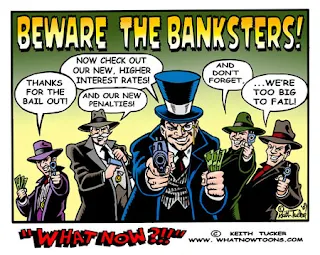

THIS IS HOW THE BANKERS ENSLAVE US.

We end up paying them 3, 4 or even 5 times as much as we originally borrowed.

Month after month after month we slave away to make them wealthy.

So how do you stop this vicious cycle?

You quit buying stuff that you can’t afford!

(It is amazing how many things we don’t NEED to have. Learn to discern the difference between "want" and "need" then explore all other options before putting it on plastic.)

Unfortunately, the vast majority of Americans have never received any formal training on how to manage finances.

Most of us were never taught any of this stuff in school. Most of us were totally unprepared when the financial predators started preying on us in college. Most of us got sucked in and spent years and years trapped in credit card debt.

When you carry a balance from month to month you are willingly signing up to become a debt servant to the big banks. They get rich while you suffer.

The sad thing is that the mainstream media is pointing to increased credit card spending as a sign that the U.S. economy is getting back to normal.

But gigantic mountains of debt is what got us into all of this trouble in the first place.

Average household debt in the United States has now reached a level of 136% of average household income.

In China that figure is only 17%.

Obviously, we have a massive, massive problem with debt in this country.

Cranking the debt spiral back up is not going to cause the economy to recover.

Well, the profits of the big banks might recover, but the rest of us will suffer.

If you want to be financially free, then it is time to pay off your credit card debt and get off the debt payment treadmill for good.

The entire global economy is on the verge of collapse, so now is a great time to renounce consumerism. Instead, we need to be preparing ourselves and our families for the hard times that are coming.

AND NOW, A SHORT TUTORIAL ON DEBT

AND YOUR SPIRIT

Consumerism is slavery. Modern life, which is based exclusively on the constant acquisition of consumer goods, is the main cause of those feelings of depression, anxiety, and loneliness that accrue in so many people’s lives today. Unlike past forms of slavery, however, there is no specific delineation between human masters and servants; rather, it is an enslavement to ideas and beliefs.

We chain ourselves willingly to things we simply do not need.

This slavery is better appreciated when we deconstruct it. First, modern consumer life enslaves the labor of individuals, tying everyone to a model of social organization that seeks to extract natural resources from the earth and convert them into consumer products.

Thus, every morning, millions upon millions of people wake up, commute to work on overcrowded transportation systems so that they can go to an office building where they sit and work with other people, most of them relative strangers, using their brains to accomplish a task that was given to them by a higher up.

Going to work is represented as a choice: since there is no taskmaster or man with a whip forcing people to do things; there is a facade that no one is forced to do anything. But coercion is inherent, because if you don’t go to work, you can’t earn a wage, and without a wage it is impossible to secure the basic necessities of life (food, water, shelter). There is no opt-out provision, no way to exit the long hours of work and go somewhere else where people might choose to live as they please.

This constriction of human potential leads to misery. How many people today fear the ringing of their alarm at some ungodly hour, awakening them to yet another day of some mind-numbing task which bears no relation to their own true wants and desires!

How common is the desire to find the “perfect job,” even when such a job cannot exist ~ for all jobs are tied to the machinery of consumption and possession. Over time, there is an existential sense of boredom, discontent and loneliness attached to everyday life, which becomes compounded with the realization that there is no end in sight.

In response to these feelings, people enslave their minds to various coping strategies that help them get through the day. Living out one’s life in an 8 x 10 cubicle is not natural; the boredom and suffering attached to the workday, like any other pain, is a warning signal given by the brain, telling its occupant that things are not right.

Some individuals take psychoactive drugs like antidepressants or alcohol as a way of getting through the day, while others cling to fundamentalist beliefs that help interpret a world without meaning.

But perhaps the most widespread coping strategy is a simple conformance to consumer life, and it is here that we witness the true genius of the consumer model. Even as it creates the social conditions that produce feelings of stress, anxiety, and loneliness, it also suggests that the answer is to literally buy into the system, to seek some purpose in the unfettered acquisition of consumer items.

Find fulfillment through shopping, it says; meanwhile, ignore the lack of choice and genuine human connectivity in your life.

Dismiss the importance of family, friends, and free time, of your precious liberty and freedom, because you have money to earn and things to purchase.

The enslavement of labor and mind results in a third form of bondage: the enslavement of the spirit.

The direction of human labor towards resource extraction and consumption, and the use of the psychological energy in justifying a life spent on continual consumer acquisition, leaves little time to spend with oneself or with others.

This is perhaps the most tragic aspect of modern life: as animals endowed with tremendous amounts of imagination and also a deep capacity to create and cultivate interpersonal connections, it is in our nature to want to relax, do nothing, to sit around and converse with others, and yet these are the activities that we have the least amount of time to do.

Over time, and through years of indoctrination through the school system, people become culturally programmed to forget that life can be much more than what TV says.

Yet even in the midst of this oppression and slavery there is still the potential for genuine freedom and human expression. No amount of material wealth can hide the deep ache for liberty that resides in every person’s heart. A better way of life is possible, but to get there requires a thorough examination of modern society.

It requires that every individual who finds herself asking if the Tower of Babel that has been constructed on the foundation of so much misery, toil, and oppression is inevitable ~ or whether there is a path back to Zion.

The demon of usury has been around for a very very long time. It is the same tribe who has been attempting to imprison the human race for millenia ~ the Sabbateans who are today's bankers.

Unlike any other form of slavery, the chains of consumerism can be dispensed with whenever a person decides for herself that it simply isn’t worth it anymore.

Freedom, in other words, is a choice ~ and the more people who realize that life can change for the better, at any moment, the more hope there is for the unleashing of the dormant potential of the human race

No comments:

Post a Comment

If your comment is not posted, it was deemed offensive.