By Mark Ames

August 23, 2012

This article was first published in the DAILY BANTER

Every week, it seems there’s another tragic

story about a suicide or murder-suicides linked to foreclosure trauma. Some of

the more spectacular murder-by-foreclosure stories the past few years have been

collected by a blog called “Greenspan’s Body Count” others, myself included, have been writing about these terrible

stories of class warfare being waged by the only side fighting it, and winning

it, as Warren Buffett rightly said.

Before the 2008 crisis, the media paid little

attention to the death toll taken on Americans by the decades-long class

warfare waged against the 99%. Now they’re impossible to ignore.

Stories like the US soldier in Iraq who committed suicide so that his wife could

collect life insurance, and save their family home from foreclosure. Or

the courtroom-suicide in Phoenix, in which a

Yale-educated banker-swindler swallowed a cyanide capsule after being found

guilty of setting his 10,000 sq foot McMansion on fire as a way of collecting

insurance and evading mortgage payments he couldn’t afford.

Despite the somewhat increased media attention

given to these tragic stories nowadays, there is one suicide directly tied to

foreclosure fraud that has been completely ignored by the media. Her name was

Tracy Lawrence, and for a brief moment last year, between the moment she turned

whistleblower and her untimely and bizarre suicide, Tracy Lawrence’s testimony

threatened to blow the entire fraud-closure criminal enterprise wide open, with

repercussions that could have easily reverberated all the way up to the major

banks and GSEs complicit in one of the greatest crimes this country has ever

experienced.

In the months since Tracy Lawrence was found

dead in her Las Vegas apartment at the age of 43, her story has only taken on

more significance ~ even as her death has been forgotten. This is a story that

demands our attention, a story we must not allow ourselves to forget.

First, some background to Tracy Lawrence’s

suicide: On November 16, 2011, the attorney general for the state of Nevada,

Catherine Cortez Masto, announced a major first-of-its-kind 606-count criminal

indictment against two Orange County, California-based title officers working

for Lender Processing Services, the country’s largest

mortgaging servicing company and the worst of the predatory “fraudclosure

mills.”

Foreclosure fraud had been devastating America

unabated for a few years, laying waste to untold hundreds of thousands of

American families. The Nevada attorney general’s criminal case against the two

LPS title officers ~ Gary Trafford and Geraldine Sheppard ~ represented, for a

brief moment, the first time in years that American justice threatened the

predatory lending class.

.

Yves Smith at Naked Capitalism was among the

first to report the Nevada AG’s indictments, rightly pointing

out the significance of going after mid-level officers in the foreclosure mill

firm as a way of launching a full-scale takedown:

“[A]s mob prosecutions have shown again and again, you start by going after the foot soldiers in the hope that they roll people higher up on the food chain. And at a minimum, this action says that the law and due process matter, and violations, particularly large scale, systematic violations, can and will be punished.”

This marked the first time that big time bank

fraudsters faced serious jail time ~ Attorney General Masto’s criminal case

sent shockwaves throughout the mortgage lending world.

More importantly, her criminal case threatened to finally change the way America deals with the bankster class that has been plundering with impunity for years.

Politically, Nevada’s criminal indictment

could have enormous repercussions; economically, the case could lead to

invalidating tens upon tens of thousands of fraudulent foreclosures conducted

in the Las Vegas area over the past few years.

The next day, the Los Angeles Times reported on the scale of the

fraud:

In what appear to be the first criminal charges to stem from the fracas over improper foreclosures last year, two Southern California title loan officers have been indicted by a Nevada grand jury for allegedly filing tens of thousands of improper documents related to Las Vegas-area foreclosures.The Clark County grand jury charged Gary Trafford, 49, of Irvine and Geraldine Sheppard, 62, of Santa Ana on 606 counts, alleging that the two headed up a vast “robo-signing” operation that resulted in the filing of tens of thousands of fraudulent foreclosure documents.The documents were filed with the Clark County recorder’s office between 2005 and 2008, according to the indictment. The two title loan officers worked for the firm Lender Processing Services, a foreclosure processing company based in Florida that has been used by most of the largest banks in the nation to process home repossessions.”

Just a few months after the Nevada AG’s

606-count criminal indictment against LPS, Missouri’s attorney general filed a

136-count criminal indictment against a unit of Lender Processing Services,

called Docx, as the New York Times reported last February. That

meant two major criminal cases.

Given the sheer scale of the crime committed ~

a plundering so brutal and devastating you’d only expect such a thing from a

conquering barbarian horde ~ what amazes me is how underreported this crime

still is, and how few Americans in the Establishment know any of the details,

beyond perhaps the word “robo-signing.”

One of the rare exceptions was the excellent

reporting done on my friend Dylan

Ratigan’s Show, as well as the unforgettable 60 Minutes segment aired last year on

foreclosure fraud and “robo-signing” mills.

The 60 Minutes investigation focused on the

fraud perpetrated by Lender Processing Services unit, Docx, which used

blatantly fraudulent “robo-signing” foreclosure documents to dispossess

Americans of their homes on behalf of the Wall Street banks.

Like the way peasants in a banana republic are treated, hundreds of thousands ~ if not millions ~ of Americans have been illegally and fraudulently evicted from their homes.

And all the while as it happened, the Obama

Administration stood by and wrung its hands ~ and that’s the kind, whitewashed

way of putting it.

Another way of looking at what the Obama

Administration did with the mass foreclosure fraud crime ~ the true and honest

way of putting it ~ is that the White House actively provided political and

legal cover for one of the largest crimes perpetrated against

Americans in modern history.

Sorry, but that’s the truth ~ and the sad

thing is, as horrible as the Obama Administration has been on housing, a

President Romney will almost certainly find a way to be even worse, even if

that worseness has to be invented. That’s one of the lessons we’ve all had to

learn these past few decades.

.

.

“Obama Lied, Hope

Died” should be the slogan

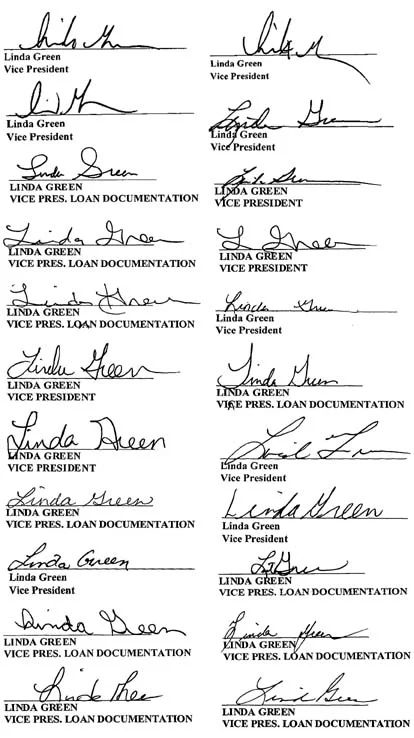

The 60 Minutes segment zeroed in

on what is now the most infamous fraudulent-signature of our time: The infamous

“Linda Green”—whose signature appeared on an impossibly large number of

foreclosure documents. A single fake “Linda Green” was officially listed as a

“vice president” at some 20 different foreclosure mills, this same “Linda

Green” signing untold thousands of fraudulent documents evicting Americans from

their homes.

Among the worst of the foreclosure servicers

abusing the fraudulent “Linda Green” signature was Docx, the unit of Lender

Processing Services which has since been shuttered.

60 Minutes tracked down the real “Linda Green” whose

name was fraudulently abused to destroy the lives of countless Americans, and

it’s worth quoting what 60 Minutes found:

We went searching for “the” Linda Green and found her in rural Georgia. She told us she has never been a bank vice president.In 2003, she was a shipping clerk for auto parts when her grandson told her about a job at a company called Docx. The company, that was once housed in Alpharetta, Ga., was a sweatshop for forged mortgage documents.Docx, and companies like it, were recreating missing mortgage assignments for the banks and providing the legally required signatures of bank vice presidents and notaries. Linda Green says she was named a bank vice president by Docx because her name was short and easy to spell. As demand exploded, Docx needed more Linda Greens.

“So you’re Linda Green?” Pelley asked Chris

Pendley.

“Yeah, can’t you tell?” Pendley, who is a man,

replied.

Pendley worked at Docx at the same time and

signed as Linda Green.

So you have now a sense of just how vast the

foreclosure fraud crime was, and how it involved not only the largest mortgage

servicer in the nation, LPS, but also all the major banks that used LPS’s

services to throw Americans out of their homes illegally and take possession of

them.

.

.

.

No fraud here folks,

looks like 1 authentic “Linda Green” to us!

Let’s rewind again to last November 16, 2011,

the day that Nevada’s attorney general Masto announced her indictment against

the two LPS title officers ~ two weeks before Tracy Lawrence took her life.

Nevada’s case against LPS rested primarily on the testimony of a whistleblower, Tracy Lawrence, who worked in Lender Processing Services’ office in Las Vegas. Her testimony threatened to unravel tens of thousands of fraudulent foreclosures in the state of Nevada between the years 2005-2008, and the criminal activities of the entire mortgage servicing industry. Nevada has suffered the worst foreclosure problem of any state in the union.

In return for turning state’s witness, Tracy

Lawrence plea bargained her charges down to a single misdemeanor charge of

falsely notarizing a signature, which carries, in the worst case scenario, a

maximum of one year in prison and a $2,000 fine.

However, her testimony could put her two LPS

superiors behind bars for decades ~ which is why many believed Nevada’s goal

was to turn those two LPS officers into state’s witnesses against LPS’s senior

executives.

On November 29, 2011 ~ just two weeks after

the Nevada attorney general announced the landmark criminal case ~ whistleblower

Tracy Lawrence was supposed to appear before a judge for her sentencing.

It should have been a routine appearance, but

she didn’t show up. Her lawyer grew anxious, called police to check on Tracy

Lawrence’s home, and that’s when they found her dead.

The timing of her death was suspicious, to say the least. Immediately, before any investigation had been conducted, Las Vegas police officially “ruled out homicide” as her cause of death.

Tracy Lawrence’s suicide was given scant

coverage in the national media. Here is one of the few national media stories

about her death, a short piece on MSNBC’s website:

FORECLOSURE FRAUD WHISTLEBLOWER FOUND DEADBy msnbc.com staffA notary public who signed tens of thousands of false documents in a massive foreclosure scam before blowing the whistle on the scandal has been found dead in her Las Vegas home.NBC station KSNV of Las Vegas reported that the woman, Tracy Lawrence, 43, was scheduled to be sentenced Monday morning after she pleaded guilty this month to notarizing the signature of an individual not in her presence. She failed to show up for her hearing, and police found her body at her home later in the day.It could not immediately be determined whether Lawrence, who faced up to one year in jail and a fine of up to $2,000, died of suicide or of natural causes, KSNV reported. Detectives said they had ruled out homicide.[ED: So quickly! And we thought only Russian police solved "crimeless" death scenes within minutes of arriving]

Lawrence came forward earlier this month and

blew the whistle on the operation, in which title officers Gary Trafford, 49,

of Irvine, Calif., and Geraldine Sheppard, 62, of Santa Ana, Calif. ~ who

worked for a Florida processing company used by most major banks to process

repossessions ~ allegedly forged signatures on tens of thousands of default

notices from 2005 to 2008.

Police said at the time that the alleged scam had thrown into question the legality of most Las Vegas home foreclosures in the past few years, leaving many people living in foreclosed-upon homes that they unknowingly don’t actually own.ED: It’s a good thing there's no motive to make a detective suspicious here or anything!

I recently called the Clark County coroner’s

office to find out if they had determined her official cause of death. A

spokesperson told me that Tracy died from “intoxication” of a combination of

Xanax (Alprazolam) and two antihistamines: Benadryl (Diphenhydramine) and

Hydroxyzine. Officially, her death was ruled a suicide.

Though there has been little public discussion

about Tracy Lawrence’s suicide, in private forums, her death sent a chill.

Although there have been reports that Lawrence was depressed and stressed from

her role as the key whistleblower, no one I know who reports on the housing

disaster unquestioningly accepts the official version, that Tracy Lawrence’s

suicide timing just happened to come at the most convenient time imaginable.

The stakes could not have been higher: As

MSNBC reported, Las Vegas police said that her testimony threatened to “throw

into question the legality of most Las Vegas home foreclosures in the past few

years.”

.

.

As one commenter darkly quipped on the site 4closurefraud.org:

I bet Linda Green signs the coroner’s report….

But seriously,Now people can’t question the validity of the documents she attested to authentic because she is dead.

When they are alive you can challenge the presumption of authenticity. It’s nearly impossible to succeed if you can’t get the notary on the stand and cross examine them. Now there are 25000 properties that are pretty much a lock to be legitimized.

One only has to remember that Las Vegas’

gambling industry was created by mobsters like Meyer Lansky ~ who is also

credited with helping invent modern offshore banking in the early 1930s in

Switzerland.

In this world, deaths ruled “suicides” are not

unheard of. One of the most spectacular examples involved the “suicide” of Roberto Calvi, chairman of Italy’s

largest private bank, who in 1982 was found hanging from London’s Blackfriars

Bridge with bricks stuffed into his pockets along with $15,000 cash. The day

before Calvi’s “suicide” his secretary “jumped” out of the bank headquarters’

fourth floor window and died ~ her death was also ruled suicide.

It took over two decades for authorities to

overturn the “suicide” verdict and state the obvious: In 2003, Italian authorities ruled Roberto Calvi’s

death a murder.

In the meantime, the fallout from Tracy

Lawrence’s suicide has been worse than predictable: In Nevada, the case against

Lender Processing Services appears to have all but fallen apart. With the Obama

Administration foisting its foreclosure fraud settlement on all the states in

January ~ a deal that left bankers happy, and everyone else screwed ~ and the key witness to the LPS case dead, the

writing was on the wall.

Masto essentially fired her deputy AG, John

Kelleher, who headed up the once-aggressive Nevada mortgage Fraud Task Force.

With Kelleher gone, the Task Force looks like its work is all but over,

as reported in local Las Vegas Channel 8 News:

“Nevada’s mortgage Fraud Task Force ~ arguably among the most aggressive in the country ~ has undergone some dramatic changes in the last few months. The changes prompted its former chief to question whether those responsible for Nevada’s housing collapse will ever be brought to justice.”

In the report, Kelleher told Channel 8: “It’s

my personal opinion that there was some kind of deal cut, involving signing the

multi-state (agreement) for whatever reason: financial, political, you can

speculate all day long and back off criminal.”

Along with Kelleher, several other Nevada

prosecutors and investigators have since been reassigned or transferred out to

pasture. In the courts, a Nevada judge all but gutted the AG’s criminal case

against Lender Processing Servicers.

Over in Missouri, the state’s criminal case

was recently quietly settled for a paltry sum, and forgotten about.

Meanwhile in LPS’s headquarter state of

Florida, the attorney general Pam Bondi has done everything to protect LPS, even firing two of her office’s attorneys who made the

mistake of investigating LPS fraud.

.

Hugh Harris, CEO of

Lender Processing Services, recently named “One of the Best Places To Work In Northeast Florida”

In a recent celebratory conference call that Lender Processing Servicers held with

financial analysts, Hugh Harris, the CEO of Lender Processing, could barely

contain himself as he gloated to analysts from Barclays, Goldman Sachs and

other financial institutions:

“First, let me just say we are very pleased to report strong second-quarter operating performance…we’ve gained greater clarity over the potential resolution of legal and regulatory issues related to the past practices.“First, we announced yesterday, we’ve settled all our legal issues with the Missouri Attorney General’s office. This settlement includes a dismissal of all criminal charges filed against DocX. Second, an motion to dismiss in the Nevada Attorney General’s case was granted in part which resulted in the scope of the suit being significantly narrowed.”

So Tracy Lawrence’s highly suspect suicide is

another major victory for the bankster class, and another giant loss for the

rest of us.

No matter what the circumstances of her

suicide ~ that is, even if she was driven to kill herself in despair, after

turning whistleblower and facing the pressure of confronting one of the biggest

criminal fraud scams in history ~ that doesn’t make her death any less

significant, or infuriating, or disturbing.

Either way, the criminal lending industry

drove a lone and lonely hero to her death.

All we can for now ~ while this country is

still controlled by a rank oligarchy ~ is remember Tracy Lawrence’s suicide, so that

some day we can learn what drove this hero to her terrifying early grave.

Mark Ames is the author of Going Postal: Rage, Murder and Rebellion from Reagan’s

Workplaces to Clinton’s Columbine.

No comments:

Post a Comment

If your comment is not posted, it was deemed offensive.