By Case Wagenvoord

08 September, 2009

Countercurrents.org

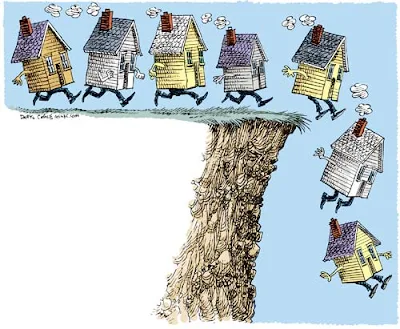

Greed is good up to a point; but beyond that point, it turns financial wizards into financial retards. Having nearly been destroyed by the securitization of mortgages, Wall Street is now casting a venal eye at bundling life insurance policies. This is like a drunk switching from vodka to scotch and expecting a better outcome.

Greed is good up to a point; but beyond that point, it turns financial wizards into financial retards. Having nearly been destroyed by the securitization of mortgages, Wall Street is now casting a venal eye at bundling life insurance policies. This is like a drunk switching from vodka to scotch and expecting a better outcome.

According to Sunday’s New York Times, here’s how it works: Say grandpa has a $2 million life insurance policy for which he pays an annual premium of $50,000. If he tried to cash it in before croaking, he’d get a paltry $58,000.

Along comes a “life settlement company” and offers him $215,000 for the policy. They continue to pay the premiums on the expectation that he is going to kick off in a couple of years, at which time they will collect on the policy and make a bundle. Such companies are already in existence.

The banks want to add a new wrinkle by bundling these purchased policies into bonds, which they would slice, dice and trance so each bond would minimize risk by bundling a variety of life expectancies and diseases.

They plan to sell these bonds to the pension funds they burned with their mortgage bonds.

Now, the problem is that the longer people live, the smaller the return on investment is.

Not to worry! The same mathematical geniuses who figured out how to slice and dice mortgages are on the job! Their solution is, “A bond made up of life settlements would ideally have policies from people with a range of diseases ~ leukemia, lung cancer, heart disease, breast cancer, diabetes, Alzheimer’s.”

This conjures up a warm image of Gramps in his hospital bed, wires and tubes running into what’s left of his body as the medical expenses add up at a frightening rate, when suddenly a savior appears in the form of a “life settlement” salesman who offers Gramps 22 cents on the dollar if Gramps will just sign over his policy.

With a trembling hand, he signs the policy over. Gramps’ family is now screwed out of a hunk of change, and a bond holder stands to make a healthy profit when Gramps croaks.

(Should the Angel of the Lord come down and lay a healing hand on Gramp's forehead, the bondholder loses money. But if the “life settlement” companies only work the terminally ill, most of whom are too drugged to think clearly, they minimize that risk.)

Let us not call them vultures because that would be an insult to a noble bird. And I am sure they have enough integrity that they would never think of working in cahoots with a life insurance company to deliberately sell life policies to the aged and ill with an eye to buying them back at pennies on the dollar just so they could be securitized.

That would as dishonest as approving a mortgage for someone who didn’t have a dime to their name.

That would as dishonest as approving a mortgage for someone who didn’t have a dime to their name.

Case Wagenvoord is a citizen who reads. He blogs at http://belacquajones.blogspot.com and welcomes comments at Wagenvoord@msn.com.

The life settlement marketplace isn’t actually about Wall Street at all. It is, rather, about providing older Americans with the opportunity to profit from an asset for which they have bought and paid. Nor is about “profiting from death”; it is about allowing seniors to benefit from a life insurance policy while they are still around to enjoy it.

ReplyDeleteOver the last decade life settlements have permitted seniors to sell their un-needed or unwanted policies at significantly better market values than they would have received by simply surrendering the policy. In today’s economy, where many seniors have lost significant parts of their retirement assets and income, in many cases they simply can no longer afford to keep paying the policy’s premium – -selling a policy for substantially more than the cash value in the policy can make a tremendous difference in that person’s ability to maintain his or her standard of living.

At the Life Insurance Settlement Association (LISA), we appreciate media attention to the life settlement market, so that American consumers are properly informed about their rights and options. Historically, almost 90 percent of life insurance policies lapse without payment of a claim. This percentage is expected to rise. The life settlement industry provides some of those policy holders the option to exit their policy when they either cannot continue paying premiums or it is in their financial best interests; leaving them in a much better position than had they surrendered their policy to the insurer. Going forward, we advocate a rational and intelligent discussion on regulation and analyst integrity that leaves out scare tactics and sensational rhetoric.

Doug Head

Executive Director

LISA

Thank you for featuring my post. To respond to Mr. Head's comment, the concern isn't with the life settlement industry but with Wall Street's plan to bundle and securitize them. My fear is the negative impact this will have on an otherwise honorable enterprise. It's not just power that corrupts, but greed as well.

ReplyDelete(Incidentally, I thought i was the only person in the world who loved "Koyanisqatsi." Have you seen the other two in the Qatsi triology?)