That the money in your bank account is not cash at all, not pieces of paper sitting in a bank vault waiting for you to withdraw them, but mere digital ones and zeros in the bank’s database, capable of being subtracted from your account at a moment’s notice, or even less. Cash that is not in your hand, it turns out, is not cash at all.

This should be reason to give pause

for thought about some of the deeper issues behind our current international

financial order: what is money, after all, if it is not physical pieces of

paper that we keep in our wallet?

And if we don’t control it, who does?

As opposed to this system of

financial control by a few bankers, heading as it is toward a seemingly

inevitable financial collapse that threatens to crash the entire world economy,

there are many alternate ideas for facilitating transactions.

Some advocate for a gold-backed

system, or some other hard asset backed currency that protects against rampant

government printing and the possibility of hyperinflation.

Others tout debt-free

government-issued money, spent into the economy on infrastructure and other

tangible benefits to the community and kept in check through taxation or

demurrage.

Yet others believe the answer lies

in more technological solutions, pointing to the recent success of the online

crypto-currency Bitcoin as an example of a different way to think about money.

While there are merits and demerits

to all of these systems, it is vital that we realize the issue of monetary

reform is not constrained to hoped-for changes to our current system that will

possibly be implemented one day in the future in all-at-once changeover.

Please enlarge thumb.

In fact, there exists right now the globe examples of alternative currencies that are currently existing alongside the Federal Reserve notes and Euros and other bankster-manipulated debt-based fiat money systems that are already helping facilitate transactions and grow local economies all around the globe. [See this and this and this and this and this.]

These alternative systems do not

require a resolution to be passed in congress or parliament, and do not require

any wholesale change in the international financial order.

These currencies already exist and

are already thriving in numerous localities around the globe. Referred to as

complementary currencies, they provide a way for communities to bypass the

inflation tax and arbitrary confiscation that defines the modern era of

central-bank administered currency.

Just as the fiat money printed up by

these central banks (or issued as debt in the form of back loans) are backed up

by the collateral of the people’s promise to pay later through the sweat of

their own labour, so too can these complementary currencies be issued through

the people’s own labour. The difference being that in this system, the money is

not controlled by banksters in closed door meetings in faraway offices, but by

the people themselves, in their own back yards.

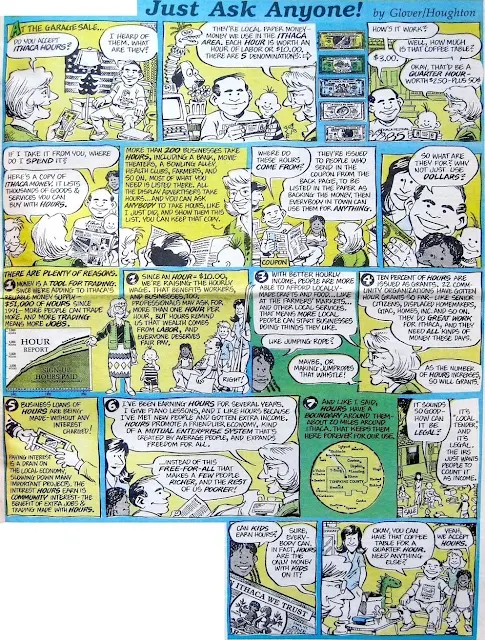

One example of a complementary

currency success story is the Ithaca

Hours currency issued in Ithaca, New York. Launched in 1991

as a way to invigorate the local economy, Ithaca Hours have since facilitated

millions of dollars in transactions and helped businesses and customers alike

bypass the uncertainties of the Federal Reserve notes of the central banking

economy.

Earlier this week I talked to Paul Glover, developer of the Ithaca

Hours system, about the project, and how it has transformed the local economy

of Ithaca.

Now, similar ideas are springing up

all across America and around the globe. From mutual credit systems to time

banking to private currencies and social currencies, there is no shortage of

ideas for how to transition off of the current system in a gradual manner while

increasing and facilitating local trade.

Last month, I had the chance to talk to Wayne

Walton, one of the organizers behind the Colorado

Mountain Hours complementary currency, about this idea, and

how it is being implemented in the Summit County area.

As with so many other ideas for

resistance of the status quo, the complementary currency

Sadly, the comfortable inertia that

the status quo offers is enough to keep many from even entertaining the idea of

using a different form of money. But as the people in Volos, Greece and other

cash-strapped locations around the globe are finding, having an established

complementary currency can help a community survive and even thrive in the

midst of the economic chaos that we can all see coming.

Please enlarge thumb

Just as currencies like Ithaca Hours and Mountain Hours have proven themselves to be successful, so have many complementary currencies withered away from lack of community support.

But in this age of Cyprus-style

bail-ins, debt ceiling crises, and the ever-looming risk of hyperinflationary

currency death spirals, it is incumbent on all of us to identify and support,

or even create, a complementary currency system in our own local area.

I admit to having not yet heard of Ithaca Hours (or Mtn. Hours) so I really appreciate you providing a brief overview here esp. as it is a simple and concise way to share the info with others.

ReplyDeleteI haven't spent much time yet researching alternative currencies but what little I have seen leaves me thinking a true 'Social Credit' styled scheme is likely the best option to replace any nation's phony currency. But that's way down the road (seemingly). Any localized options such as Trading Hours is a step in the right direction, esp. as it takes both the government's and the banker's dirty hands out of the equations.